How Diversity And Inclusion Impact Earnings Before Interest and Taxes (EBIT)margins.

Research has consistently shown that workplace diversity and inclusion can positively impact a company’s financial performance, including its earnings before interest and taxes (EBIT).

A study published in the Harvard Business Review found that companies with above-average total diversity had 9% higher EBIT margins, on average. In addition, a report by McKinsey & Company highlights that companies that are diversity leaders have a systematic approach and take bold steps to strengthen inclusion, which can lead to improved financial performance, including higher EBIT margins.

It is worth noting that the relationship between diversity and inclusion and financial performance is complex and multifaceted. While diversity and inclusion alone are not a guarantee of financial success, they can contribute to it by increasing innovation, attracting and retaining top talent, and better reflecting the needs and preferences of a diverse customer base.

To fully reap the benefits of workplace diversity and inclusion, it is important for companies to take a systematic approach to create an inclusive culture and ensuring the representation of diverse talent. This can involve implementing diversity and inclusion training, creating employee resource groups, and fostering a culture of open communication and collaboration.

By prioritising diversity and inclusion, companies can not only improve their bottom line but also create a more equitable and inclusive workplace for all employees.

McKinsey & Company’s global study of more than 1,000 companies in 15 countries found that organizations in the top quartile of gender diversity were more likely to outperform on profitability — 25% more likely for gender-diverse executive teams and 28% more likely for gender-diverse boards.

Organisations in the top quartile for ethnic/cultural diversity among executives were 36% more likely to achieve above-average profitability. At the other end of the spectrum, companies in the bottom quartile for both gender and ethnic/cultural diversity were 27% less likely to experience profitability above the industry average. Researchers measured profitability by using average EBIT margins.

- The Boston Consulting Group and the Technical University of Munich conducted a survey of diversity managers, HR executives, and managing directors at 171 companies across Germany, Austria, and Switzerland. The study found higher levels of diversity in management positions contribute to increased revenue from new products and services. The research also revealed that companies that establish favorable work conditions for employees have higher EBIT margins (17%) than those who do not (13%)

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) margins

Credit Suisse studied 30,000 senior executives at over 3,000 companies across the world. Among their findings: companies in which women held 20% or more management roles generated 2% higher EBITDA margins than companies with 15% or less women in management roles.

Gross and net margins

- Researchers from the Peterson Institute for International Economics conducted a global survey of financial and governance data from 21,980 publicly traded firms across 91 countries. The study revealed a positive correlation between the presence of women in senior leadership and profitability (defined as gross margin and net margin). This correlation proved stronger for women in executive leadership positions than for women on boards.

Internal rate of return

- In a study of private equity firms in Europe and North America, researchers discovered that buyout teams with at least one woman produced an average 12% higher in internal rate of return (IRR) compared with all-male teams. The presence of gender diversity also contributed to a reduced average capital loss ratio of funds by 8%-12%.

Stock returns

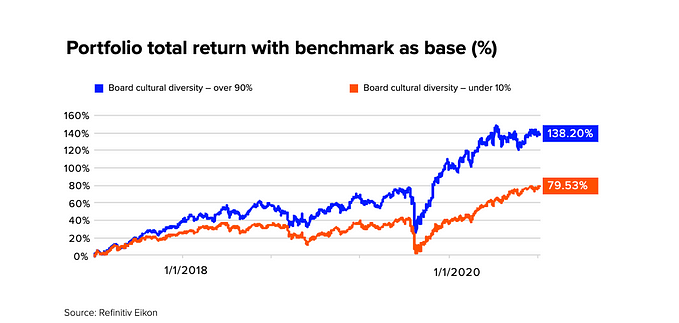

- Companies with consistent, inclusive workplace cultures — especially as experienced by historically underrepresented groups — also outperformed the S&P 500 in average annual stock returns during the Great Recession, according to Great Place to Work’s analysis of financial performance from 2006–2014.

- Research analysts from The Wall Street Journal ranked companies in the S&P 500 based on 10 metrics related to diversity and inclusion performance. These metrics included the share of women in leadership roles, the presence of diversity and inclusion programs, and board demographics.

The 20 highest-performing companies in the ranking generated a higher operating profit margin (12%) compared to the lowest-ranking companies (8%). When the researchers examined average compounded annual total stock returns over both 5 years and 10 years, they again found that the highest-ranking companies outperformed the lowest-ranking companies.