The Role of Diversity and Inclusion in Responsible Investing.

Introduction

Responsible investing, also known as sustainable, socially responsible, or impact investing, refers to the practice of considering environmental, social, and governance (ESG) factors in investment decisions. This approach aims to generate not only financial returns but also positive social and environmental impact.

As the world becomes increasingly diverse and interconnected, the concept of responsible investing has evolved to include a focus on diversity and inclusion. In this blog, we will explore the role of diversity and inclusion in responsible investing and how investors can incorporate these values into their investment strategies.

Definition of responsible investing:

Responsible investing has been defined in various ways, but a common definition is the integration of ESG factors into investment analysis and decision-making. This can take the form of actively selecting investments that align with certain values or avoiding investments that do not align with these values.

The goal of responsible investing is to create positive change through investment decisions, while also seeking financial returns. This approach recognizes that financial performance and societal impact are not mutually exclusive and that companies that prioritize ESG factors are likely to be more sustainable and resilient in the long-term.

The importance of diversity and inclusion in responsible investing:

Diversity and inclusion have become increasingly important considerations in responsible investing in recent years. This is because diversity and inclusion are not only important values in their own right, but they are also closely linked to a company’s financial performance and societal impact.

Research has shown that diverse and inclusive companies tend to have better financial performance, as they are able to tap into a wider range of talent and ideas. In addition, companies that prioritize diversity and inclusion are often better able to serve diverse customer bases and to navigate complex global markets.

From a societal impact perspective, diversity and inclusion are also important because they contribute to a more equitable and just society. By investing in diverse and inclusive companies, investors can help to drive positive change and promote social justice.

What is diversity and inclusion in responsible investing?

Diversity in responsible investing refers to the representation of different groups within a company or investment portfolio. This can include diversity of gender, race, ethnicity, sexual orientation, age, ability, and other characteristics.

Inclusion in responsible investing refers to the creation of an environment that values and includes all individuals, regardless of their background or characteristics. This can include practices such as equal pay, equal opportunity, and promoting inclusivity in the workplace.

The different types of diversity that can be considered in responsible investing:

There are many different types of diversity that can be considered in responsible investing. Some common categories of diversity include:

- Gender diversity: This refers to the representation of both men and women in a company or investment portfolio. Research has shown that companies with more gender diverse leadership tend to have better financial performance.

- Race and ethnicity diversity: This refers to the representation of different racial and ethnic groups within a company or investment portfolio. Companies that prioritize diversity and inclusion tend to be more innovative and better able to serve diverse customer bases.

- Sexual orientation diversity: This refers to the representation of individuals of different sexual orientations within a company or investment portfolio. Companies that are inclusive of LGBTQ+ employees tend to have higher levels of employee engagement and satisfaction.

- Age diversity: This refers to the representation of individuals of different ages within a company or investment portfolio. Age diversity can bring a range of perspectives and experiences to the workplace.

- Ability diversity: This refers to the representation of individuals with disabilities within a company or investment portfolio. Companies that prioritize ability diversity tend to have higher levels of employee engagement and retention.

The benefits of a diverse and inclusive investment portfolio:

There are several benefits to a diverse and inclusive investment portfolio. Some of the key benefits include:

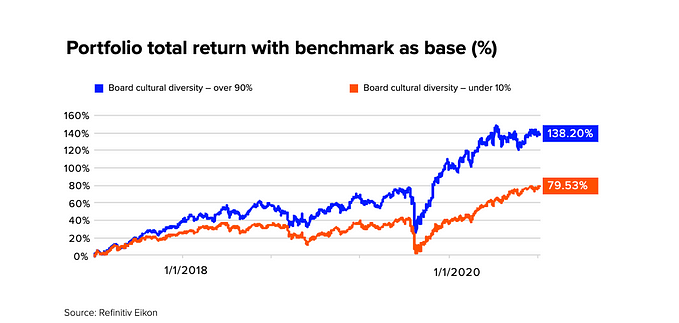

- Financial performance: Research has shown that companies with diverse and inclusive workplaces tend to have better financial performance. This is because diverse teams are able to tap into a wider range of talent and ideas, leading to increased innovation and productivity.

- Risk management: A diverse and inclusive investment portfolio can also help to mitigate risk. This is because diverse perspectives can help to identify potential risks that may have been missed by more homogenous teams.

- Alignment with values: For many investors, responsible investing is about aligning their investments with their values. A diverse and inclusive investment portfolio can help to ensure that investments align with values around social justice and equality

- Positive societal impact: By investing in diverse and inclusive companies, investors can help to drive positive change and promote social justice. This can lead to a more equitable and just society.

How to incorporate diversity and inclusion into responsible investing:

There are several ways that investors can incorporate diversity and inclusion into their responsible investing strategies. Some of the key strategies include:

Screening for diversity and inclusion in potential investments:

One way to incorporate diversity and inclusion into responsible investing is to screen for these factors when considering potential investments. This can involve researching the diversity and inclusion policies and practices of companies and evaluating their track record in these areas.

There are several resources available to investors for conducting this type of analysis. For example, many companies publish diversity and inclusion reports that provide information on the demographics of their workforce and leadership, as well as their policies and practices around diversity and inclusion. Investors can also use third-party tools such as the Bloomberg Gender-Equality Index (GEI) or the Disability Index to assess the diversity and inclusion performance of potential investments.

Engaging with portfolio companies on diversity and inclusion issues:

Another way to incorporate diversity and inclusion into responsible investing is to engage with portfolio companies on these issues. This can involve communicating with companies about their diversity and inclusion policies and practices and encouraging them to improve in these areas.

Investors can engage with companies through a variety of channels, including voting at shareholder meetings, submitting shareholder proposals, and participating in dialogue with company management. By actively engaging with portfolio companies on diversity and inclusion issues, investors can help to drive positive change and promote better practices in these areas.

Investing in diverse and inclusive funds or managers:

Another way to incorporate diversity and inclusion into responsible investing is to invest in funds or managers that prioritize these values. Many fund managers now offer products that specifically target diversity and inclusion in their investments. These products may focus on investing in companies with diverse leadership, or on sectors that have a positive impact on diverse communities.

By investing in diverse and inclusive funds or managers, investors can more easily incorporate these values into their investment portfolios and have a greater impact on driving positive change in these areas.

Challenges to incorporating diversity and inclusion in responsible investing:

While there are many benefits to incorporating diversity and inclusion into responsible investing, there are also several challenges that investors may face in doing so.

Some of the key challenges include:

Limited data on diversity and inclusion in the investment industry:

One challenge to incorporating diversity and inclusion into responsible investing is the limited availability of data on these issues in the investment industry. While many companies publish diversity and inclusion reports, the information provided is often limited and may not be comparable across different companies. This can make it difficult for investors to accurately assess the diversity and inclusion performance of potential investments.

Potential biases in the investment process:

Another challenge to incorporating diversity and inclusion into responsible investing is the potential for biases to influence investment decisions. This can include biases related to diversity and inclusion, as well as other types of biases such as cognitive or unconscious biases.

To address these biases, investors may need to be proactive in seeking out diverse perspectives and challenging their own assumptions. This can involve engaging with diverse investment advisors and analysts, as well as using tools such as bias checklists to help identify and mitigate potential biases.

The need for long-term thinking and patience in seeing the impact of diversity and inclusion efforts:

Finally, incorporating diversity and inclusion into responsible investing requires a long-term perspective and patience. This is because the impact of diversity and inclusion efforts may not be immediately apparent, and it may take time to see the full benefits of these efforts.

Investors may need to be patient and willing to take a longer-term view in order to see the full impact of diversity and inclusion in their investment portfolios. This may involve considering the long-term sustainability and resilience of companies, rather than focusing solely on short-term financial performance.

Examples of successful diversity and inclusion in responsible investing:

There are many examples of companies and funds that have successfully incorporated diversity and inclusion into their investment strategies. Some of these examples include:

Case studies of companies or funds that have successfully incorporated diversity and inclusion into their investment strategies:

- Goldman Sachs: Goldman Sachs has made significant progress in improving diversity and inclusion in its workforce, including setting targets for increasing the representation of women and underrepresented minorities in leadership positions. In 2021, the company reached its goal of having 50% of its new analysts and associates be women or underrepresented minorities.

- BlackRock: BlackRock, the world’s largest asset manager, has made a commitment to promoting diversity and inclusion in its investment decisions. This includes establishing a diversity and inclusion team to identify and invest in companies with diverse leadership and establishing partnerships with diverse fund managers.

- Prudential Financial: Prudential Financial, a global financial services company, has made a commitment to incorporating ESG factors into its investment decisions, including a focus on diversity and inclusion. This has included investing in diverse fund managers and engaging with portfolio companies on diversity and inclusion issues.

The positive impact of these efforts on financial performance and societal impact:

The efforts of these companies and others to incorporate diversity and inclusion into their investment strategies have had a positive impact on both financial performance and societal impact. Research has shown that companies with diverse and inclusive workplaces tend to have better financial performance, as they are able to tap into a wider range of talent and ideas. In addition, companies that prioritize diversity and inclusion are often better able to serve diverse customer bases and to navigate complex global markets.

From a societal impact perspective, diversity and inclusion efforts have the potential to drive positive change and promote social justice. By investing in diverse and inclusive companies, investors can help to create a more equitable and just society.

Conclusion:

In this blog, we have explored the role of diversity and inclusion in responsible investing. We have seen that diversity and inclusion are important values in their own right, and are also closely linked to a company’s financial performance and societal impact.

We have also examined how investors can incorporate diversity and inclusion into their responsible investing strategies, including screening for these factors in potential investments, engaging with portfolio companies on these issues, and investing in diverse and inclusive funds or managers.

Despite the many benefits of incorporating diversity and inclusion into responsible investing, there are also several challenges that investors may face in doing so. These include limited data on these issues in the investment industry, potential biases in the investment process, and the need for long-term thinking and patience in seeing the impact of diversity and inclusion efforts.

Despite these challenges, there are many examples of companies and funds that have successfully incorporated diversity and inclusion into their investment strategies, with positive impacts on both financial performance and societal impact. This demonstrates the potential for responsible investors to drive positive change through their investment decisions.

As the world becomes increasingly diverse and interconnected, it is more important than ever for investors to prioritize diversity and inclusion in their investment strategies. By doing so, investors can not only generate financial returns but also contribute to a more equitable and just society.

Gibran Registe-Charles is the ESG Director and CEO / Founder of Urban Edge Capital a ESG D&I hedge fund.